It’s no secret that the great orchestras - Chicago, Minnesota, Atlanta, among others - have been struggling lately, particularly over the last few weeks as contracts get renewed. We have narrowly avoided a nationwide collapse of numerous symphonic titans, with thousands of jobs and outstanding concerts in the balance. The latest financial crisis hit them later - and harder - than it hit most other firms. Why is that? And how can we insulate our arts industry from such economic turbulence in the future? To find out, let’s take a look at an orchestra’s business model as compared with that of a paper company (I’m an old The Office fan). There are two parties in the paper market - buyers and sellers. In a recession, people tighten their belts and try to consume as little paper as possible. Now the firm can’t sell as much paper. The firm calls up the manufacturer and tells them to produce 85% as much paper this year as they did last year, or they’ll end up with unsold stock since people are demanding so much less paper. The manufacturer says OK, and then a relatively small number of people in the paper factory take wage cuts, work fewer hours or get laid off. Everyone survives the recession.

In the market for live symphonic performance, there are still two parties, audience (dropping serious dough to hear some Mahler) and musicians (easily identified by the suspicious boxes they’re carrying around). Suddenly, the audience gets word that the Great Recession’s a’comin’, and many decide they can’t pay $140 to hear Mahler - some of them have lost jobs, some aren’t getting the raises they expect, and they now get plenty of misery and despair in their lives anyway (sorry, Mahler). So far, this is just like when the paper market shrinks. But here’s where the two examples diverge.

Remember the paper supplier could pretty easily shrink its manufacturing when demand for paper tanked. In an orchestra, you can’t just fire the section with the fewest notes when fewer people are going to concerts (if you could, we would have gotten rid of the brass ages ago). Nor can you just price the tickets higher - even fewer people will pay for the concert and you’ll end up with a lower revenue. What to do?

Okay, I promised myself I’d never put charts in this blog but I feel like I might not have any choice here.

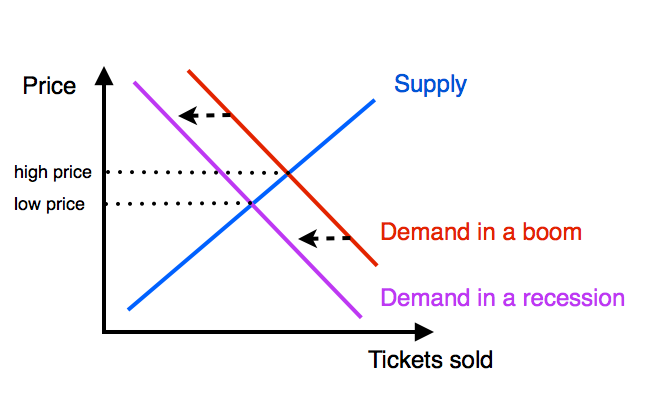

Skip this if you remember intro econ: If you’re an economics major, this little graph probably flashes in front of your eyes every night when you go to sleep. Ugly as it is, it’s a pretty useful tool. We have the blue line, which represents how many tickets the orchestra is willing to sell for a given price (its slope makes sense; the higher the price, the more the orchestra is willing to overwork itself to get that extra money). Then we have the red line, which shows how much people are willing to pay for a ticket (if you price the ticket higher, fewer people are going to be able to afford the ticket). The ticket is priced at the intersection of these two lines - that’s the point at which people are willing to pay for the ticket, while the orchestra is willing to sell it. Now, when the recession hits, people aren’t as willing to part with their cash for an orchestra concert, so the red line shifts into the purple line and the equilibrium price and quantity of tickets sold shifts down. This is a basic model of how prices in markets work.

Skip this if you remember intro econ: If you’re an economics major, this little graph probably flashes in front of your eyes every night when you go to sleep. Ugly as it is, it’s a pretty useful tool. We have the blue line, which represents how many tickets the orchestra is willing to sell for a given price (its slope makes sense; the higher the price, the more the orchestra is willing to overwork itself to get that extra money). Then we have the red line, which shows how much people are willing to pay for a ticket (if you price the ticket higher, fewer people are going to be able to afford the ticket). The ticket is priced at the intersection of these two lines - that’s the point at which people are willing to pay for the ticket, while the orchestra is willing to sell it. Now, when the recession hits, people aren’t as willing to part with their cash for an orchestra concert, so the red line shifts into the purple line and the equilibrium price and quantity of tickets sold shifts down. This is a basic model of how prices in markets work.

The Economics 101 answer to the orchestra’s problem - simple! Reduce the wages of the orchestra musicians and administrators until the recession is over. This doesn’t work in real life though - remember, these wages are written out in contracts, so they can’t shift during a recession. Even between contract signings (such as these last few weeks), people are very, very averse to taking cuts in their wage (or even reductions in raises), exogenous macroeconomic circumstances be darned. Employers know that wage cuts are major morale-killers, so they’d honestly rather fire a worker or two than reduce everyone’s paycheck by 5% - even if this results in lower combined income. This effect - a cultural resistance to wage cuts from both the employer and employee - is known to economists as Downward Nominal Wage Rigidity and it means deadweight loss (lost utility overall) and mass unemployment when we could otherwise just be taking relatively small docks to our paychecks (think 1-2%). In an orchestra, the problem is aggravated because we can’t just fire a few people - if there’s any firing going on, we have to fire everyone (unless you like Mahler with no brass). But the orchestra can’t keep on operating if the ticket revenues are less than the orchestra’s combined wages and other operating costs. Something’s gotta give. And that’s when they decide to take a season off, or shut down completely.

I have the deepest, most sincere respect for the members of these orchestras. Some are my old teachers, colleagues and friends. They are exceptionally talented, absurdly well-trained and steadfastly dedicated. The CSO has been home to many of the individuals who inspired me to become what I am now, like Fritz Reiner and János Starker. I believe that orchestras, to this day, forge and harbor many of the most incredible people who walk the earth. I love many branches of music but there are some moments of profound artistic greatness that seem exclusive to the symphony. Every time I hear that an orchestra is shutting down for any period of time, I really cannot come up with a truer word than heartbreak.

Beyond sentimentality, shutting down the orchestra is not an economic solution. It’s not utility or profit-maximizing. But it seems like the only alternative to a nominal wage cut. Or is it? The orchestra might just be saved by...inflation. Yep, inflation. That thing your dad talks about when he remembers gas being 17 cents per gallon. How could this work?

You know how year to year, everything gets a little more expensive? But then you get a pay raise, so it all kinda evens out? You’ve probably heard this phenomenon referred to as inflation. The value of dollars - measured in terms of real goods - is going down. On the face of it, you might feel like you got ripped off - the price of some bread went up from $2.19 to $2.23. Where’s that extra money going to come from? Well, it turns out, you see those extra dollars in your paycheck as well (plus a tiny bit more on average, since the world’s real standard of living is improving). The moral of the story is unless you’re holding a lot of money in the bank (think millions), annual inflation under 4% won’t hurt you very much. Not only that, it turns out that inflation discourages people from stuffing large sums of money uselessly in their mattresses, since the value of that money is slowly being eroded. This incentivizes them to spend the money on things like market investments, real estate...concert tickets. (this boost of aggregate demand is another benefit of the monetary stimulus that would trigger inflation, but not the focus today - we’re focusing on the direct psychological way by which inflation can solve our problem)

Anyway, what has inflation got to do with orchestras shutting down...or staying on? Remember earlier we showed that our culturally-valued downward nominal wage rigidity is responsible for the freeze-up of an orchestra that would really rather keep playing, if it weren’t for this cultural aversion to small wage cuts. Well, consider this - the contracts (and morale) are indexed nominally. That is, they’re valued in dollars. If we reduce the value of a dollar ever so slightly, we can temporarily reduce the real value of wages by a practically unnoticeable amount - without triggering the morale-killer that is nominal wage cuts. We do this by increasing our nation’s target inflation rate by a very small amount via monetary policy (long story short, the Fed can do that - that’s a whole other topic). Since the Fed has increased the opportunity cost of hoarding money and shifted aggregate demand out, we’ve reduced the real price of our concert tickets (even if they’re still the same nominally). More people come to our concerts. The musicians still get paid according to their contracts and expectations. Morale stays up and everyone's happy.

Maybe this sounds too small - how much could this cold number (4% annual inflation) really boost ticket sales? Well, you’d be surprised. If it leads to a 4% boost in nominal revenue (which practically defines inflation), all else being equal, the musicians will probably take home a 4% annual nominal pay raise.

As an aside: For comparison, the recent strike of CSO musicians led to an agreed-upon 1.5% annual increase (approximate baseline) in salary in their new three-year contract (this corresponds with our current inflation rate that is typically estimated to be around 2%).

I’m not sure why people reference Zimbabwe and the Weimar Republic (examples of inflation gone crazy) to attack the idea of 4% inflation. Those countries had thousands, even million-percent annual inflation rates. We’re talking about 4%. The infamous “stagflation” (stagnation+inflation, get it?) was not inflation alone, but also wild changes in the prices of certain goods, resulting from supply shocks (OPEC in the Middle East). So it’s not really an applicable example if you’re arguing that the USA should keep inflation low.

I’ve heard defeatists talking about the “end of the American orchestra” and how this shutdown was inevitable - predictable, even. I disagree. I argue that the world needs this music, now more than ever. This art is NOT a luxury reserved for the ultra-rich and the classically educated, even if that’s the impression that orchestras must fight from here on out. Music has been there for us at the ends of the earth, from concert halls to concentration camps, when people had to decide between a concert and some of life’s most fundamental amenities. There is no reason, economic or otherwise, why this art can’t flourish in the coming decades more than it ever has.

Me, I’m optimistic. As long as someone up top has the economic know-how and political force of will, the symphony has many magnificent years ahead of it.